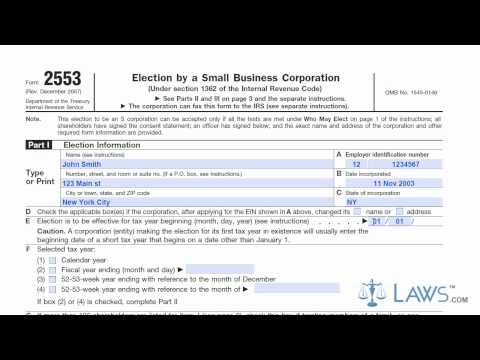

Laws calm legal forms guide form 2553 is a United States Internal Revenue Service tax form used for small businesses to elect tax designation as an S corporation. In order to qualify as an S corporation, your business must not pay federal income tax but instead pass on income tax through to the shareholders. The form 2553 can be obtained through the IRS's website or by obtaining the documents through a local tax office. The tax form is to be filed by a corporate taxpayer at any time in order to register as an S corporation for federal tax purposes. First, enter the Corporation's name and contact information at the top of the form. Include the address of the corporation, employer identification number, date, and state of incorporation. Select the tax year for which the corporation is claiming S designation. If it is your first year of incorporation, start with the date of the shortened tax year. Make an election in Part F for the tax year that you wish your corporation to be taxed on. You can select the standard calendar year, a fiscal year, or any specific 52 to 53 week period of your choosing. In Part G, check the if you have over 100 shareholders but are accounting for family members as a single shareholder. Consult the instructions if you are unsure of what qualifies as family shareholders. Supply a contact in Parts H and I if a representative should be contacted in regards to your corporation's tax status. If you have missed a deadline filing the form 2553 and are filing a C-corporation 1120 tax filing, you must state the reason for the missed deadline and supply supporting documents. Sign and date the bottom portion of the first page. For Part 1 on the second page, you must list every shareholder...

Award-winning PDF software

instructions 2553 Form: What You Should Know

A tax year elected under section 1361 d. A tax year elected under Sec. 1362(f). d. A tax year elected under Sec. 1361 (other than through Sec. 6662). d. A tax year elected under Sec. 1361 (other than through Sec. 1363). d. A tax year elected under Sec. 6662 (other than through Sec. 1363). c. A tax year elected under Secs. 1366 and 1367. d. A tax year elected under Sec. 1366 (other than through Sec. 1368). A tax year elected under Sec. 1368 (other than through Sec. 1368). d. A tax year elected under Sec. 1368 (other than through Sec. 1369). In the case of an interest-bearing savings account (s and s) A tax year elected under Secs. 6662 (other than through Sec. 1363) and 6662 (other than through Sec. 1364). For an S corporation, the election is for a period of time less than a full year A tax year elected under Sec. 1361 (other than through Sec. 6662). For an LLC, the election is for a period of time less than a full year d. A tax year elected under Sec. 1362(f), (g), etc. A tax year elected under Sec. 1363 (other than through Sec. 6662). For a corporation: A tax year elected under Sec. 1362(f), (g), etc. For a limited liability company: A tax year elected under Sec. 1362(f), (g), etc. A tax year elected under Sec. 1363, (other than through Sec. 133) d. A tax year elected under Sec. 1363 (other than through Sec. 1364) d. A tax year elected under Sec. 1363 (other than through Sec. 1366), (ii) Sec. 6662 (other than through Sec. 1363). For a partnership: d. A tax year elected under Sec. 1461. d. For a qualified partnership, Sec. 1361(a)(4). d. For a trust: d. For a domestic trust, Sec. 6601(d). An S corporation may elect to be treated as a domestic partnership d. For the purposes of subsection (d) of section 1361, a taxable domestic partnership has a d.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 2553, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 2553 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 2553 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 2553 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form instructions 2553